Taking a Payment Test Drive

With Faith comes clarity - What if I literally put the cart before the horse by starting to make payments to myself while my car is still running? Let’s say I do some research. First, find a car I like (most dealership websites will have the approximate payment amount listed). Next, call my insurance company's customer service or use the online quote tool to see how much it will cost to add the new car and remove my old car from my plan. For this example, I will use a car payment of $600 per month and an increase in insurance of $100. This means that I will have to pay an additional $700 per month to get the car. Now, let's consider if my budget can do that. If I'm NOT able to save $700 a month, I would need to find a cheaper car (A GAL GOTTA EAT)! If I am able to save the payment and maintain a comfortable lifestyle, the money is still available for emergency use. Then when it's time to buy the car, I will already have made several payments or in the best-case scenario - I could possibly pay it off. The reward is being confident of what I'm able to afford ahead of time. Additionally, if I use the money saved to make the down payment, I could opt for a lower car payment or a shorter financing term which will likely get me a better interest rate on the car loan. I can also just keep the savings as back up for a rainy day or spend it on a road trip in my new car. Just imagine, if my current car keeps on ticking for five more years to make this goal even more successful - that will be icing on the cake!

It is amazing how prayer and planning can make a scary decision easier. If you need help with making a decision or need an accountability partner, let me know. I am now a certified goal life coach. Together we can make things happen. Much Success, Carla

0 Comments

and even an appendage. Logical people would think "if you are hiding all that, what else are you hiding? " Are you a serial killer or have a messy house? It is a myth that looks shouldn't matter. The truth is that your appearance is a huge part of others understanding who you are, so just be yourself. Take look at how I have styled this less-than-$20 dress three different ways: Halter for a little fun; the usual off-shoulder look for an everyday style; and a side tie for hanging out with the girls. No matter what you wear, just remember to do you!

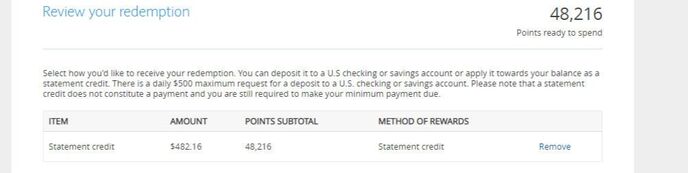

BEING FINANCIALLY FAITHFUL IN 2021 In challenging times, I cannot stress the need for financial awareness and literacy. For most, the tools to improve your financial situation are already in your possession. In fact, living within your means can be reality. It all starts with sacrifice. Ask yourself these questions? Do you have a budget? When discussing financial issues with people, I have realized that most people do not have a budget. They have no method of keeping track of what comes in and what goes out. Without my monthly budget sheet, I would be totally lost. I know that in any given month I will be only be paid twice, and I know what expenses need to be covered from each of those paychecks. This simple tracking allows me to understand what limits I have on my spending. It also leads the way to putting that occasional third paycheck directly into the savings account. If you have no clue what amounts should be in your budget for groceries or extras like grooming the dog or getting your nails done, track your habits for a month or two. Budgets are not made to create restrictions; they are just a guide, so you can achieve financial balance and reduce stress. A happy purse makes a happy person. What time of year causes the most stress on your budget? When kids were introduced into my life, the holidays became a major challenge financially. You want them to have everything you did not have as a child, so the Christmas tree had to have lots of gifts for each. Do you know that you are the worst enemy to your budget during Christmas? Kids honestly just want to enjoy your time and attention. You can give them the joy of opening presents and still stay within your budget. But when you know you are going to overspend, have a plan! My plan is my cash back bonus. Review my earnings below: So basically, I made $482 to spend at Christmas without lifting a finger. How does it work? Whether you have credit card balances or not, you can designate one card that offers a cash back as your payoff card. This means that for the normal expenses that will you pay for in cash monthly, use the card instead and pay it off each month. I'm blessed to be in a position to have only one card, so I use my credit card just like a debit card - for almost everything and I pay it off by the first of each month. In addition to earning cash back on everything, I also can track my balance and be aware of my spending. If I go over, I just carry a small balance into the next month and pay it off before the 28-day grace period to avoid interest. I love this plan and the extra cash at Christmas is the icing on the cake! I use my credit card to make money instead of getting in the interest trap - been there and done that!  What can you do? Again, I cannot stress how difficult this year has been. Money stresses can affect your health and relationships. Take some time this month to consider ways you can save money or create a plan for saving money. Financial awareness and literacy involve being proactive about your choices. There are some very creative ways that people have come up with to make sure they have the money need to keep afloat. I remember someone sharing with me years ago that they would always round up when writing amounts in their check register (like if they spent $6.07 they would subtract $7 in their log) and ended up with $500 extra in the bank. That may not work today with online banking, but never underestimate the power of creating a strategy and seeing it through. With that said, I hope you have an awesomely Blessed and totally rewarding 2021. Hugs, Carla Your relationship with money is important If you ask most single women what is the most important quality in a partner, they would likely say faithfulness or loyalty. Just as we have expectations of a love relationship, we have to set expectations of our relationship with money. Do you start the year out saying you are going to put a certain amount away? Do you talk about saving but end up spending more? How do you think your savings account feels when it is always having to cover your checking account from overdrafts? You are literally cheating on your money and being the worst type of player - promising that you are going to make steady deposits and it just never gets done! Take a moment and reflect on why your saving account is low or gets depleted each month. I know many people struggle with money and lost wages due to the pandemic, but wouldn't things would have been a little easier if you had $10-20K in the bank beforehand? Think back over the last 10 years. Let's say you calculated how much money you spent ordering food instead of cooking. I recently stopped at a fast food drive thru and got combo meals for my son and I. It costed nearly $17. That same amount of money could have bought breakfast, lunch, and a decent dinner at the grocery store. Also consider how much leftovers you threw out last year. Each time I clean out the frig, I'm throwing away at least 3-4 meals. Let's not mention the items we purchase and never use. I'm sure that if over the last 10 years I would have been more aware of how I treated my money, then I would have had a lot more in the bank. So before this first payday of 2021, take a moment and think about your relationship with money and how you can achieve a healthy relationship that grows your bank accounts. How can you keep your savings account happy? In the next few days, I will also post some tips I have learned and practice to help with my finances. Let's make our relationship with money a prosperous one. |

AuthorHello There! Categories

All

Archives

June 2022

|

RSS Feed

RSS Feed