Time to Cash in

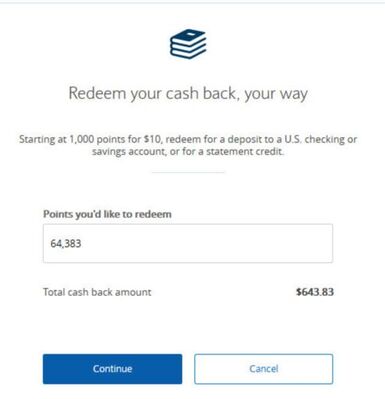

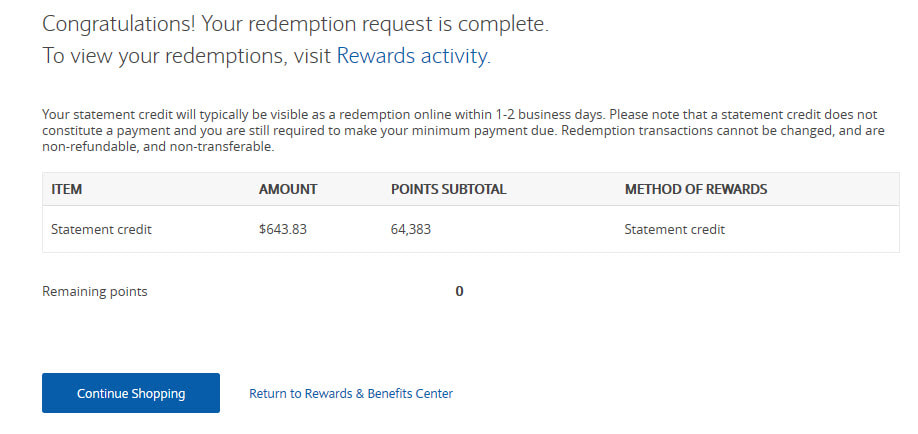

Here's how to grab on to this awesome financial challenge. What you should do: 1. Know that carrying a balance on a credit card is not a good decision. However since one cannot predict or be prepared for every emergency, try to pay off any credit card balances as soon as possible. This plan does not work if you have balances, since interest rates will always be higher than the cash back percentage - That's just how the laws of the credit card industry works. 2. Know your limits. Swiping without thought or preparation is never a good idea. Use your credit card for everything, but treat it like cash. You must maintain a balance you can pay off every month. I send my payment on the 1st of each month so that I can feel like I'm starting the new month at $0. 3. Do not touch the cashback stash! Yes, you may earn $20 one month and $100 another, but never cash in until the end of the year. Let it build to enjoy your reward. 4. Review your options. I always use my balance as a statement credit, but there are also options like getting it as a check or buying gift items out of the rewards store. Either way, cash back bonuses provide extra cash to your budget. I'm so excited! Let's see what kind of bonus 2020 brings!

0 Comments

Leave a Reply. |

AuthorHello There! Categories

All

Archives

June 2022

|

RSS Feed

RSS Feed