Financial Tip: Common Sense Cash Back

How would it feel to have $500 - 1000 dollars deposited in your bank account at the end of each year without paying a cent for it?

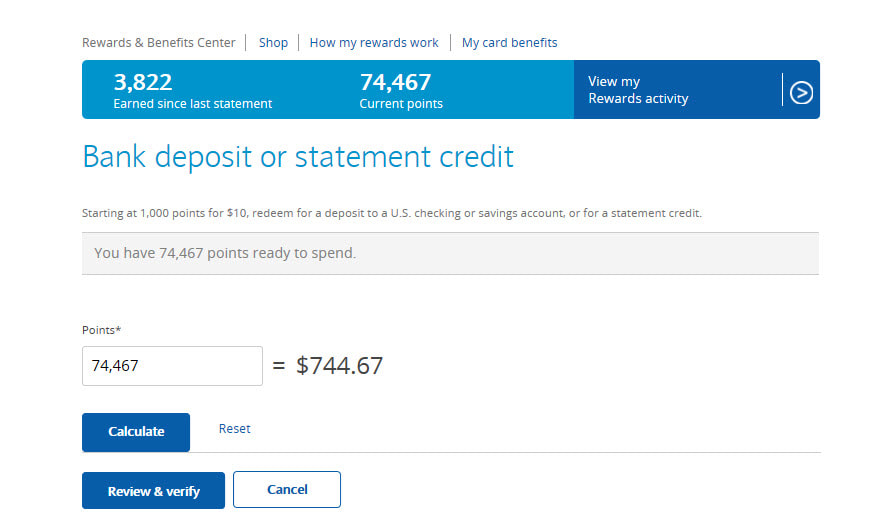

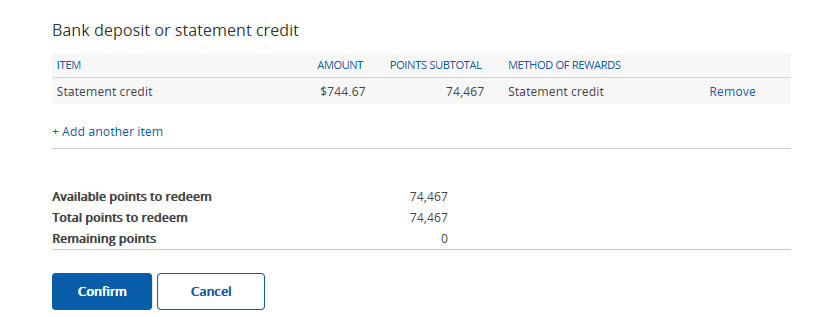

I just requested my statement credit of over $700 - yep totally paid for me. Oh, how I love the cashback option on my credit card. Simply put - I get paid to pay my bills and spend money on groceries, gas, and eating out. You have probably tried using a cashback credit card and gave up when the return was only a few cents. Well, when you have a strategy, it works! All you need is a little discipline.

Here is how to maximize your cashback bonus and make it work for you.

When I say DISCIPLINE, I mean you have to stick with these strategies:

Need help with your unsecured debt? See below!

0 Comments

Leave a Reply. |

AuthorHello There! Categories

All

Archives

June 2022

|

RSS Feed

RSS Feed